From the Team @ HPLT 12/23

Business & Markets Update

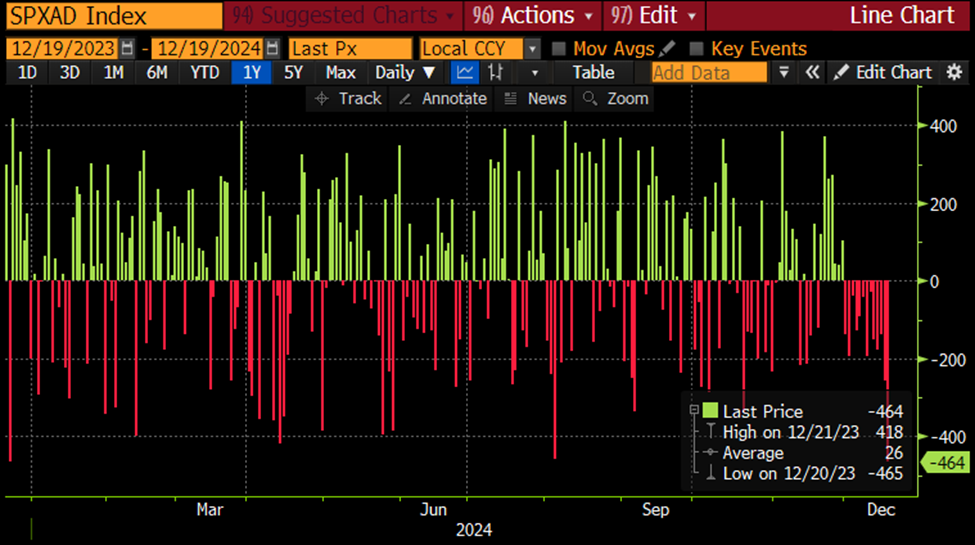

It was a whirlwind of a week, a week that felt more like a month. Highlighting the deteriorating ‘Breadth’ in the US equity market in the last write-up was topical, because the sole focus of this past week was BAD BREADTH, particularly the first 4 days. The S&P 500 saw a larger number of decliners (stocks that went down) than gainers (stocks that went up) for 14 STRAIGHT SESSIONS before a fairly notable bounce on Friday. The highlight, from a macro perspective, was the December Fed meeting on Wednesday, where a 25-basis point cut was announced but more importantly, guidance around only 2 cuts for 2025 (vs the 3-4 that markets were expecting) weighed heavily on equities. The -2.95% move on Wednesday was the worst day since early August for stocks. The weekly range on the 10y treasury yield was 4.35-4.60%, and the closely-watched VIX (basic volatility benchmark) spiked > the 28 level for the first time in months.

Some charts to visualize some of these dynamics below:

Volatility Index

2-Week chart of the equal-weighted S&P

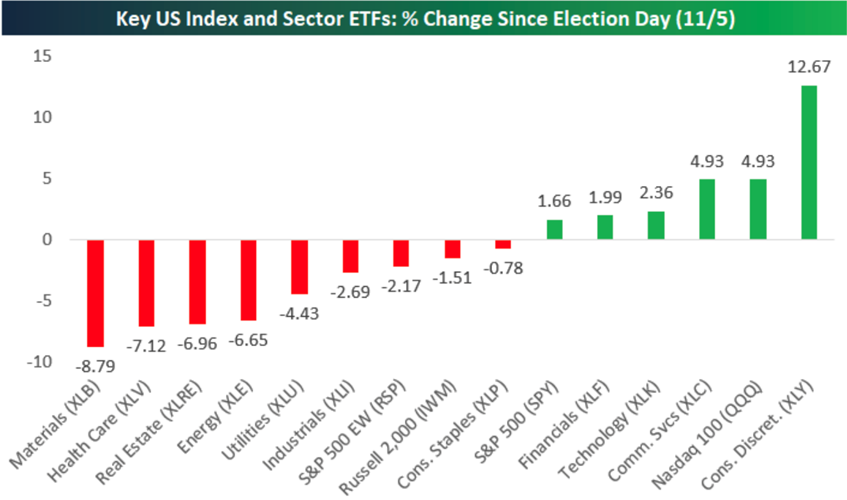

Many of you may be wondering what the last 2 weeks mean in the context of what has happened in equity markets since the Presidential Election. The post-election rally saw stocks (across sectors) on the move higher, with a shift in fiscal priorities, an anticipation around massive deregulation, a potential for new tariffs, and notable changes in corporate tax rates (just to name a few). Stocks popped, sentiment was peaking, and it marked one of the strongest post-election performances in decades. In the last 2 weeks, markets seem to be recalibrating and many of the areas of the market that benefitted in the days following the election, have given a decent amount of performance back. So, what does that mean on a sector level? Good one here:

Maybe we got a little hot-to-trot and maybe these following 2 charts are a good contra-indicator of why stocks took a breather in the last couple weeks. The number of Americans expecting stock prices to be higher in 12 months hit a fresh high (56.4%) the first week of Dec, and at the same time institutional money managers were recording their lowest percentage of ‘Cash allocation’ (meaning very little dollars NOT being put to work in the market) … And so began the mini-correction that we’ve just seen.

There are 5.5 trading days left in the year (early close on Christmas Eve!), the market is -1.68% so far this month, which bucks the trend for historically strong Decembers… the so-called Santa Claus Rally we hear about this time of year. One might think (hope? 😊) these last 5+ days would be a lower key / lower volumes / quiet-market-into-the-holiday type vibe but this month has been anything but that so far, here’s to hoping!!… Good snapshot on + monthly returns for S&P:

Top Reads

FAA bans drone flights over NJ (Link)

What the top 75 college sports programs are worth (Link)

More men are addicted to the ‘crack cocaine’ of the stock market (Link)

Jerome Powell just showed Donald Trump who’s boss (Link)

How Vuori reached a $5.5b valuation by taking share from Lululemon (Link)

OpenAI makes ChatGPT available for phone calls and texts (Link)

People are the new brands (Link)

Americans under 40 are richer than ever but have money woes (Link)

Why CEOs are sucking up to Trump (Link)

My ‘Worth Your Time’ Video of the week:

I’ve watched this 33 min video from Graham Weaver a number of times in the last 12 months. I absolutely LOVE IT. This lecture introduces the concept of leveraging ASYMMETRY- not just in investing but in life as a whole… and breaks down Graham’s 4 core principles:

Do Hard Things

Do Your Thing

Do It for Decades

Write Your Story

Quick Housekeeping: The Markets Update section of Sweat Equity will hit pause for a couple weeks as markets and general news flow quiet down (*knocks on wood) into both Christmas and New Years weeks, and will pick back up on Jan 13th… See you in’25, and in the meantime MERRY CHRISTMAS & HAPPY FREEKIN’ HOLIDAYS!! --TC